MT5 Platform Doo Prime

MetaTrader 5 Platform Overview

Doo Prime’s implementation of MetaTrader 5 provides access to multiple asset classes through a single interface. The platform integrates with institutional liquidity providers for competitive pricing across markets. Advanced execution technology ensures rapid order processing and completion. Custom server infrastructure maintains stable platform performance during peak trading periods. Multiple redundancy systems prevent service interruptions during market hours. Technical analysis tools include 38 built-in indicators and 44 graphical objects. Trading functions support various order types and execution modes.

Platform Specifications:

Feature | Details | Availability |

Technical Indicators | 38 built-in | 24/7 |

Graphical Objects | 44 types | All sessions |

Timeframes | 21 options | Market hours |

Order Types | 6 variations | Trading hours |

Market Depth | Full access | Exchange dependent |

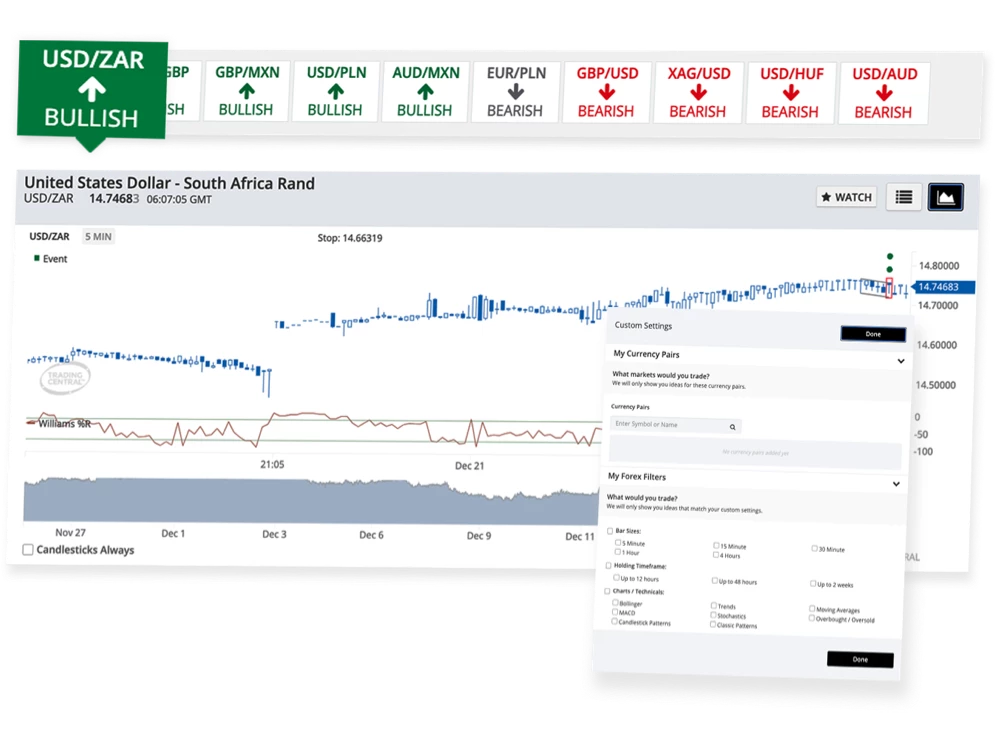

Technical Analysis Capabilities

Chart analysis tools support 21 different timeframes for market analysis. Custom indicator creation enables specialized strategy development. Pattern recognition algorithms identify potential trading opportunities. Drawing tools assist with technical analysis implementation. Multiple chart types display price information effectively. Automated analysis tools process market data continuously. Technical studies calculate various market parameters.

Analysis Tools Integration

Available analysis features:

- Multiple chart types

- Technical indicators

- Custom studies

- Drawing tools

- Pattern recognition

- Trend analysis

- Volatility measurement

Advanced Trading Functions

MetaTrader 5 supports six different types of pending orders for strategy implementation. Multiple position management tools enable efficient trade monitoring. Hedging capabilities allow simultaneous long and short positions. Netting functions consolidate similar positions automatically. Advanced order execution modes support various trading approaches. Real-time position tracking displays current market exposure. Risk management tools calculate potential outcomes.

Order Management Features

Trading capabilities include:

- Market orders

- Limit orders

- Stop orders

- Stop limit orders

- Trailing stops

- OCO orders

Automated Trading Implementation

MQL5 programming language enables custom Expert Advisor development. Strategy testing tools validate automated trading systems. Multiple timeframe analysis supports complex trading algorithms. Back-testing functions evaluate historical performance metrics. Optimization tools improve automated strategy parameters. Real-time monitoring tracks automated system performance. Error handling routines maintain stable operation.

Trading Algorithm Support:

Function | Capability | Usage |

Expert Advisors | Custom coding | Automated trading |

Custom Indicators | MQL5 development | Technical analysis |

Scripts | Task automation | Trading support |

Libraries | Code reuse | Development |

Position Management Tools

Advanced position monitoring displays real-time exposure levels. Multiple order modification options enable strategy adjustments. Stop loss and take profit functions protect positions. Position sizing calculators assist trade planning. Portfolio analysis shows current market exposure. Trade history maintains detailed transaction records. Risk calculation tools evaluate potential outcomes.

Risk Management Functions

Position controls include:

- Margin calculators

- Exposure monitoring

- Loss limitations

- Profit targets

- Risk parameters

- Position limits

- Account protections

Interface Customization Options

Workspace layouts save individual trading preferences. Multiple monitor support enables expanded viewing options. Custom indicator placement organizes technical analysis. Color scheme options adjust visual preferences. Font size settings enhance readability. Toolbar customization improves functionality access. Hotkey assignment speeds common operations.

Market Data Integration

Real-time price feeds stream from multiple liquidity sources. Market depth information displays order book conditions. Economic calendar tracks market-moving events. News feed integration provides market updates. Corporate action notifications alert position holders. Technical data updates continuously during market hours. Historical data enables detailed analysis capabilities.

Data Feed Components

Market information includes:

- Price quotations

- Order book depth

- Trading volumes

- Market events

- Technical data

- Historical information

Platform Security Features

Multi-level authentication protects account access procedures. Data encryption secures information transmission channels. Regular security updates address potential vulnerabilities. Account monitoring systems detect unusual activities. Automated logout occurs during extended inactivity. IP restriction options limit access points. Two-factor authentication enhances security.

Market Access Configuration

Direct market access enables rapid order execution. Multiple server options optimize connection speed. Virtual hosting services reduce latency issues. Connection monitoring ensures stable market access. Automated reconnection maintains platform availability. Network optimization reduces data requirements. System resources allocation maintains performance.

Connection Parameters

Access specifications include:

- Multiple servers

- Backup connections

- Speed optimization

- Stability monitoring

- Resource management

- Performance tracking

FAQ

MetaTrader 5 includes 38 built-in technical indicators with capability for custom indicator development.

Yes, MT5 supports automated trading through Expert Advisors developed using the MQL5 programming language.

MT5 supports six types of orders including market, limit, stop, stop limit, trailing stop, and OCO orders.