Account type Doo Prime

Account Types Overview

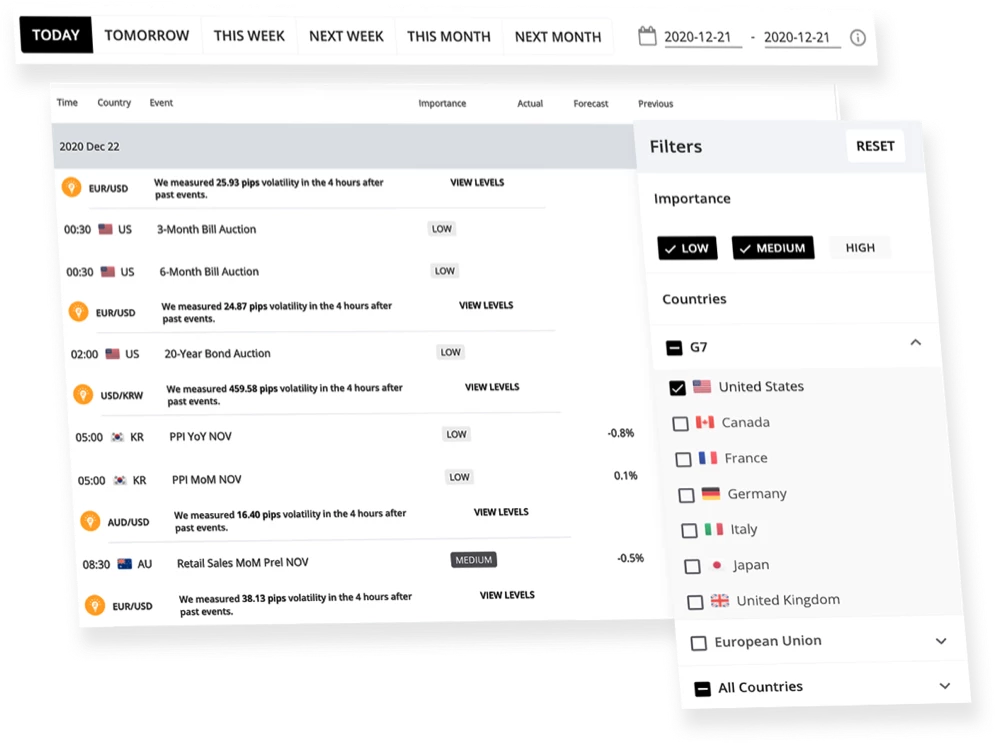

Doo Prime offers three distinct account types tailored to different trading requirements and experience levels. The CENT account enables market access with zero minimum deposit requirement. STP accounts provide direct market execution without dealing desk intervention. ECN accounts access institutional-grade pricing with raw spreads from 0.0 pips. Each account type maintains specific trading conditions and features. Multiple base currencies support international traders. Account protection measures safeguard client funds. Regular account monitoring ensures optimal performance.

Account Specifications:

| Feature | CENT Account | STP Account | ECN Account |

| Minimum Deposit | $0 | $100 | $100 |

| Spreads From | 1.0 pips | 1.0 pips | 0.0 pips |

| Commission | No | No | Yes |

| Leverage | Up to 1:1000 | Up to 1:1000 | Up to 1:1000 |

| Execution | Market | Market | ECN |

| Demo Available | No | Yes | Yes |

CENT Trading Conditions

CENT specifications include:

- Zero minimum deposit

- Standard spreads

- No commissions

- Market execution

- Full platform access

- Multiple instruments

CENT Account Features

CENT accounts enable market participation without initial capital requirements. Trading conditions include competitive spreads from 1.0 pips. No commission charges apply to trading activities. Maximum leverage reaches 1:1000 for qualified clients. Multiple trading platforms support various strategies. Real-time execution ensures rapid order processing. Account features match standard trading requirements.

Advanced Account Parameters:

| Parameter | Specification | Availability |

| Order Types | All standard | 24/7 |

| Position Size | 0.01 lots min | All sessions |

| Margin Call | 50% | Automated |

| Stop Out | 30% | Automated |

| Instruments | All markets | Trading hours |

Trading conditions adapt to market volatility. Position sizing enables micro-lot trading. Multiple currency pairs maintain consistent spreads. Commodity trading includes standard conditions. Index trading reflects market hours. Stock CFDs follow exchange schedules.

STP Account Capabilities

STP accounts provide direct market access through liquidity providers. Order execution occurs without dealing desk intervention. Spreads start from 1.0 pips across major pairs. Commission-free trading reduces transaction costs. Demo account access enables strategy testing. Multiple base currencies support international traders. Advanced trading tools support various strategies.

Trading Instrument Access:

| Market | Instruments | Trading Hours |

| Forex | 60+ pairs | 24/5 |

| Stocks | 300+ CFDs | Exchange hours |

| Commodities | Multiple futures | Market specific |

Account Management Tools

Real-time monitoring displays account status continuously. Multiple risk management tools protect positions. Account statements generate detailed trading records. Performance analysis tracks trading results. Position management enables strategy adjustments. Financial operations process through secure channels. Support services assist account operations.

Risk Management Features

Protection measures include:

- Stop loss orders

- Take profit levels

- Margin monitoring

- Position limits

- Exposure tracking

- Account alerts

ECN Account Features

ECN accounts access institutional liquidity pools directly. Raw spreads start from 0.0 pips during main sessions. Commission charges apply per million traded. Advanced execution technology ensures rapid processing. Market depth information displays real-time. Multiple trading platforms support various strategies. Professional tools enable advanced trading.

ECN Trading Environment

ECN features include:

- Direct market access

- Institutional liquidity

- Raw spreads

- Rapid execution

- Market depth

- Professional tools

- Advanced analysis

Platform Accessibility

Trading platforms include:

- MetaTrader 4

- MetaTrader 5

- InTrade platform

- Mobile applications

- Web terminals

- FIX API access

Trading Platform Integration

MetaTrader 4 supports traditional trading approaches. MetaTrader 5 enables multi-asset trading strategies. InTrade platform provides mobile-first solutions. FIX API enables custom system integration. Multiple platform access ensures trading flexibility. Technical analysis tools support strategy development. Automated trading enables algorithm implementation.

Account Security Measures

Multi-factor authentication protects account access. Segregated accounts maintain fund separation. Regular security updates protect systems. Transaction monitoring detects unusual activities. Encryption protocols secure data transmission. Automated logout prevents unauthorized access. Security teams monitor system protection.

Account Funding Methods

Multiple deposit options support account funding. Withdrawal processes follow security protocols. Internal transfers enable fund movement. Currency conversion services support transactions. Processing times maintain industry standards. Security measures protect financial operations. Documentation requirements ensure compliance.

Professional Services Access

Dedicated account managers assist professional traders. Market analysis provides trading information. Technical support resolves platform issues. Corporate services support institutional clients. Educational resources enable skill development. Regular updates maintain service standards. Support teams provide continuous assistance.

FAQ

CENT accounts require no minimum deposit, while STP and ECN accounts require $100 minimum deposit.

CENT and STP accounts offer commission-free trading with spreads from 1.0 pips, while ECN accounts provide raw spreads from 0.0 pips with commission charges.

All account types offer leverage up to 1:1000 for qualified clients, subject to regulatory requirements and risk management policies.